Understanding the Impact of Interest Rates on Mortgage Loans: What Homebuyers Need to Know

#### Interest Rates on Mortgage LoansInterest rates on mortgage loans play a crucial role in the home-buying process. They determine how much you will pay e……

#### Interest Rates on Mortgage Loans

Interest rates on mortgage loans play a crucial role in the home-buying process. They determine how much you will pay each month for your mortgage and can significantly affect your overall financial health. When considering a mortgage, it’s essential to understand how these rates work and the factors that influence them.

#### What Are Interest Rates on Mortgage Loans?

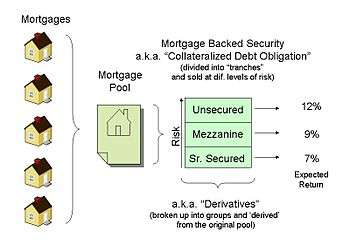

Interest rates on mortgage loans refer to the cost of borrowing money to purchase a home. This rate is expressed as a percentage of the loan amount and is typically fixed or variable. A fixed-rate mortgage means that your interest rate remains the same throughout the life of the loan, providing stability in your monthly payments. On the other hand, a variable-rate mortgage may start with a lower rate, but it can fluctuate based on market conditions, which can lead to unpredictable payment amounts in the future.

#### Factors Influencing Interest Rates on Mortgage Loans

Several factors influence interest rates on mortgage loans, including:

1. **Economic Conditions**: The overall health of the economy plays a significant role in determining interest rates. When the economy is strong, interest rates tend to rise due to increased demand for loans. Conversely, during economic downturns, rates may decrease to encourage borrowing.

2. **Inflation**: Inflation affects purchasing power and can lead to higher interest rates. Lenders adjust rates to compensate for the decrease in money value over time.

3. **Federal Reserve Policies**: The Federal Reserve (the central bank of the United States) influences interest rates through its monetary policy. When the Fed raises or lowers the federal funds rate, it indirectly impacts mortgage rates.

4. **Credit Score**: Your credit score is a reflection of your creditworthiness. A higher credit score typically results in lower interest rates on mortgage loans, as lenders view you as a lower risk.

5. **Loan Type and Term**: Different types of loans (e.g., FHA, VA, conventional) and varying loan terms (e.g., 15-year, 30-year) can also affect the interest rates offered to borrowers.

#### The Importance of Monitoring Interest Rates on Mortgage Loans

For potential homebuyers, staying informed about interest rates on mortgage loans is vital. Even a slight change in interest rates can have a significant impact on your monthly payment and the total amount paid over the life of the loan. For instance, a 1% increase in interest rates can add thousands of dollars to the total cost of a mortgage.

#### How to Secure the Best Interest Rates on Mortgage Loans

To secure the best interest rates on mortgage loans, consider the following tips:

1. **Improve Your Credit Score**: Pay down debts, make payments on time, and avoid opening new credit accounts before applying for a mortgage.

2. **Shop Around**: Different lenders offer varying rates. It’s essential to compare offers from multiple lenders to find the best deal.

3. **Consider the Loan Type**: Research different types of mortgage loans to determine which one best fits your financial situation and offers competitive rates.

4. **Lock in Your Rate**: If you find a favorable rate, consider locking it in to protect yourself from potential increases before closing on your home.

#### Conclusion

Understanding interest rates on mortgage loans is crucial for any homebuyer. By being informed about the factors that influence these rates and taking proactive steps to secure the best possible deal, you can make a more educated decision when purchasing your home. Always remember to consider both the short-term and long-term implications of the interest rates on your mortgage, as they will affect your financial situation for years to come.