Exploring Lucrative Career Opportunities in Mortgage Loan Servicing Jobs

#### Understanding Mortgage Loan Servicing JobsMortgage loan servicing jobs are essential roles within the financial industry, focusing on managing and main……

#### Understanding Mortgage Loan Servicing Jobs

Mortgage loan servicing jobs are essential roles within the financial industry, focusing on managing and maintaining mortgage loans after they have been originated. These positions are critical as they ensure that borrowers make their payments on time and that the loan is managed according to the terms agreed upon. Individuals in these roles typically handle customer inquiries, process payments, manage escrow accounts, and work to resolve any issues that may arise during the life of the loan.

#### The Importance of Mortgage Loan Servicing

The mortgage servicing sector plays a vital role in the overall health of the housing market and the economy. Proper loan servicing helps to prevent defaults and foreclosures, which can have devastating effects on families and communities. By ensuring that borrowers are supported throughout the life of their loans, mortgage loan servicers contribute to financial stability and promote responsible lending practices.

#### Skills Required for Mortgage Loan Servicing Jobs

To excel in mortgage loan servicing jobs, candidates need a blend of technical and interpersonal skills. Key skills include:

1. **Attention to Detail**: Accuracy is paramount in managing loan accounts, processing payments, and maintaining records.

2. **Communication Skills**: Servicers frequently interact with borrowers, so clear and empathetic communication is essential.

3. **Problem-Solving Abilities**: Issues may arise that require quick thinking and effective solutions to ensure customer satisfaction and compliance with regulations.

4. **Knowledge of Mortgage Regulations**: Understanding the legal aspects of mortgage servicing is crucial for compliance and risk management.

#### Career Path and Opportunities

Mortgage loan servicing jobs offer a variety of career paths. Entry-level positions may include roles such as loan servicing representatives or customer service associates. With experience, individuals can advance to supervisory or managerial roles, overseeing teams of servicers and ensuring that operations run smoothly.

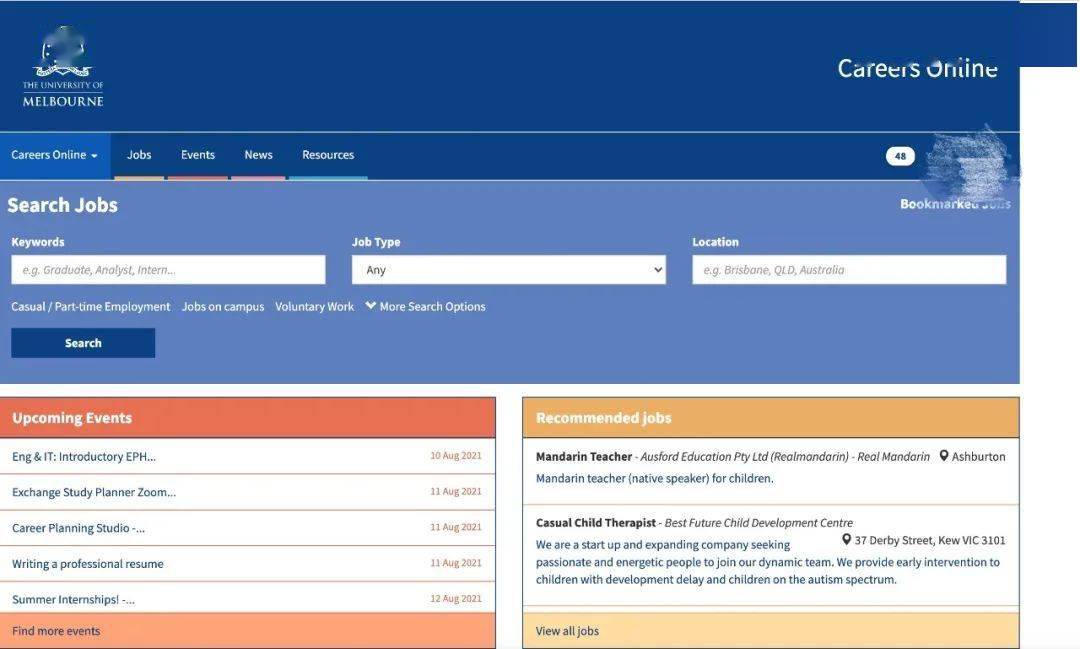

Additionally, the rise of technology in the financial sector has created new opportunities in mortgage servicing. Positions related to data analysis, software management, and digital customer service are becoming increasingly important as companies seek to improve efficiency and enhance the customer experience.

#### Job Market Outlook

The job market for mortgage loan servicing jobs remains robust, driven by a steady demand for housing and ongoing refinancing activities. As interest rates fluctuate, borrowers may seek to refinance their loans, leading to increased servicing needs. Moreover, the growth of online mortgage services has expanded the industry, creating new roles and opportunities for job seekers.

#### Conclusion

In summary, mortgage loan servicing jobs are a crucial component of the financial services industry, providing stability and support to borrowers throughout their loan journey. With a strong demand for skilled professionals and a variety of career paths available, this field offers promising opportunities for those looking to build a rewarding career in finance. By developing the necessary skills and staying informed about industry trends, individuals can position themselves for success in this dynamic and essential sector.