Unlock the Benefits of Homeownership: How to Refinance with VA Loan for Maximum Savings

#### Refinance with VA LoanRefinancing your mortgage can be a strategic move to reduce your monthly payments, lower interest rates, or access equity in your……

#### Refinance with VA Loan

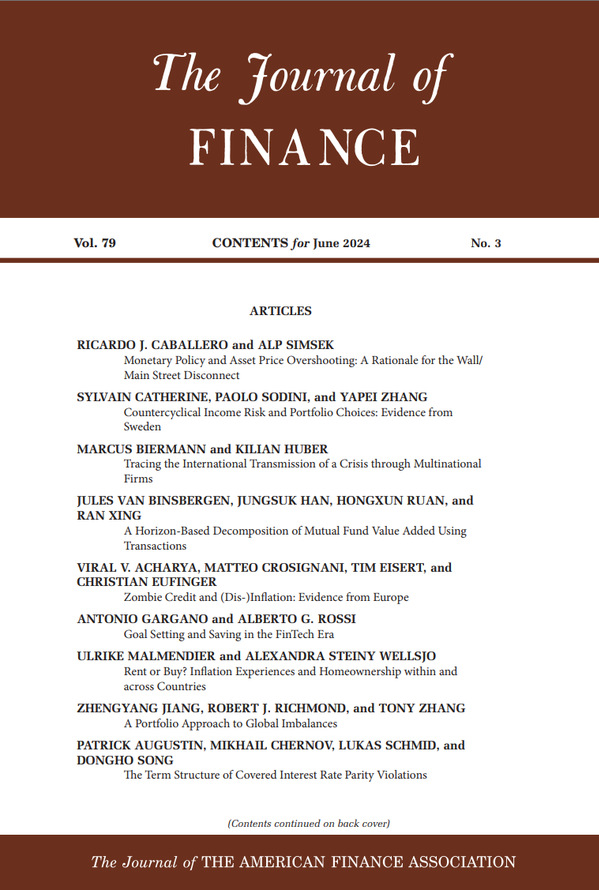

Refinancing your mortgage can be a strategic move to reduce your monthly payments, lower interest rates, or access equity in your home. For eligible veterans and active-duty service members, refinancing with a VA loan offers distinct advantages that can significantly enhance your financial situation. In this article, we will explore what it means to refinance with a VA loan, the benefits it provides, and the steps you need to take to make the most of this opportunity.

#### Understanding VA Loans

VA loans are a type of mortgage backed by the U.S. Department of Veterans Affairs. They are designed to help veterans, active-duty service members, and certain members of the National Guard and Reserves purchase homes with favorable terms. One of the standout features of VA loans is that they do not require a down payment, and they typically come with lower interest rates compared to conventional loans.

#### Benefits of Refinancing with a VA Loan

1. **No Down Payment Required**: One of the most significant advantages of refinancing with a VA loan is the ability to refinance without a down payment. This is especially beneficial for veterans who may want to access their home equity without incurring additional costs.

2. **Lower Interest Rates**: VA loans often offer lower interest rates than conventional loans. This can translate into substantial savings over the life of the loan, making refinancing a financially sound decision.

3. **No Private Mortgage Insurance (PMI)**: Unlike conventional loans, VA loans do not require borrowers to pay for private mortgage insurance, which can lead to further savings.

4. **Streamlined Refinancing Options**: The VA offers a streamlined refinancing option known as the Interest Rate Reduction Refinance Loan (IRRRL). This program allows veterans to refinance their existing VA loans with minimal documentation and lower fees, making the process quick and efficient.

5. **Access to Home Equity**: Refinancing with a VA loan can also provide homeowners with access to their home equity, allowing them to fund renovations, pay off debt, or cover other expenses.

#### Steps to Refinance with a VA Loan

1. **Check Your Eligibility**: Before you begin the refinancing process, ensure that you meet the eligibility requirements for a VA loan. This typically includes having a valid Certificate of Eligibility (COE).

2. **Evaluate Your Current Mortgage**: Analyze your current mortgage terms, including interest rates and remaining balance. This will help you determine if refinancing makes financial sense.

3. **Shop Around for Lenders**: Not all lenders offer the same terms for VA loans, so it’s essential to shop around. Compare interest rates, fees, and customer reviews to find the best lender for your needs.

4. **Gather Necessary Documentation**: While VA loans often require less documentation than conventional loans, you will still need to provide some information, such as proof of income, credit history, and your COE.

5. **Submit Your Application**: Once you’ve chosen a lender and gathered your documentation, you can submit your application. The lender will review your information and determine your eligibility for refinancing.

6. **Close on Your New Loan**: If approved, you will proceed to closing, where you will sign the necessary paperwork. After closing, your new loan will pay off your existing mortgage, and you will start making payments on the refinanced loan.

#### Conclusion

Refinancing with a VA loan can be an excellent way for veterans and active-duty service members to save money and improve their financial situation. With benefits like no down payment, lower interest rates, and access to home equity, it’s a viable option worth considering. By understanding the process and taking the necessary steps, you can unlock the advantages of homeownership and secure a brighter financial future. If you’re considering refinancing, now is the time to explore your options and take advantage of the benefits that come with a VA loan.