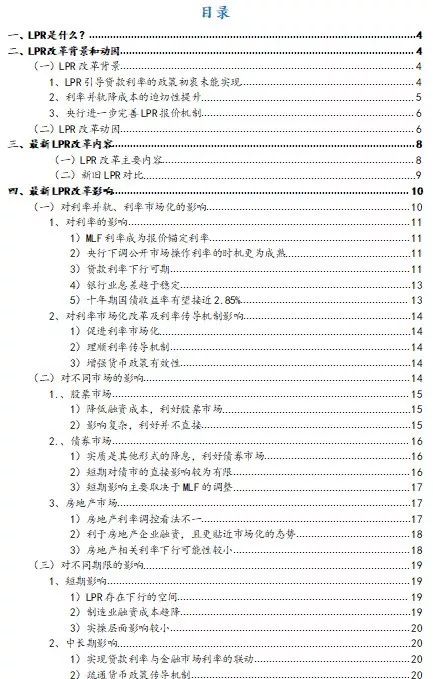

Understanding Equity Loan vs HELOC: Which is Right for You?

#### Equity Loan vs HELOCWhen it comes to leveraging the value of your home, two popular options are equity loans and HELOCs (Home Equity Lines of Credit……

#### Equity Loan vs HELOC

When it comes to leveraging the value of your home, two popular options are equity loans and HELOCs (Home Equity Lines of Credit). Both allow homeowners to tap into their home equity, but they serve different financial needs and come with distinct features. In this article, we will explore the key differences between equity loans and HELOCs, helping you make an informed decision based on your financial goals.

#### What is an Equity Loan?

An equity loan, also known as a second mortgage, allows you to borrow a lump sum of money against the equity you have built up in your home. This type of loan typically has a fixed interest rate and a set repayment term, often ranging from 5 to 30 years. Because the loan is secured by your home, lenders usually offer lower interest rates compared to unsecured loans.

The amount you can borrow depends on the equity in your home, which is calculated by subtracting your mortgage balance from your home’s current market value. For example, if your home is worth $300,000 and you owe $200,000, you have $100,000 in equity. Lenders typically allow you to borrow up to 80-90% of that equity, meaning you could potentially access between $80,000 to $90,000.

#### What is a HELOC?

A HELOC (Home Equity Line of Credit) is a revolving line of credit that allows homeowners to borrow against their home equity, similar to a credit card. With a HELOC, you can withdraw funds as needed, up to a predetermined limit, and only pay interest on the amount you actually borrow. This makes HELOCs a flexible option for those who may need funds for ongoing expenses, such as home renovations or education costs.

HELOCs usually come with variable interest rates, which means your monthly payments can fluctuate over time. The draw period, which typically lasts 5 to 10 years, allows you to borrow and repay as needed. After this period, you enter the repayment phase, where you can no longer borrow and must start paying back the principal along with interest.

#### Key Differences Between Equity Loans and HELOCs

1. **Structure of Borrowing**: An equity loan provides a one-time lump sum, while a HELOC offers a line of credit that you can draw from as needed.

2. **Interest Rates**: Equity loans generally have fixed interest rates, whereas HELOCs often have variable rates that can change over time.

3. **Repayment Terms**: Equity loans have set repayment terms, while HELOCs have a draw period followed by a repayment phase.

4. **Flexibility**: HELOCs provide more flexibility in borrowing and repayment, making them suitable for ongoing expenses, whereas equity loans are better for one-time large expenses.

#### Which Option is Right for You?

Choosing between an equity loan and a HELOC depends on your financial situation and needs. If you need a large sum of money for a specific purpose and prefer predictable payments, an equity loan may be the better choice. On the other hand, if you anticipate needing funds over time and want the flexibility to borrow as needed, a HELOC might be more suitable.

Ultimately, it’s essential to assess your financial goals, budget, and risk tolerance before deciding. Consulting with a financial advisor can also provide valuable insights tailored to your unique circumstances. By understanding the differences between equity loans and HELOCs, you can make an informed decision that aligns with your financial objectives.