Unlock Your Dream Home with USDA County Loan Limits: A Comprehensive Guide to Eligible Areas and Benefits

Guide or Summary:Understanding USDA County Loan LimitsWhat Are USDA County Loan Limits?Why Are USDA County Loan Limits Important?How Are USDA County Loan Li……

Guide or Summary:

- Understanding USDA County Loan Limits

- What Are USDA County Loan Limits?

- Why Are USDA County Loan Limits Important?

- How Are USDA County Loan Limits Determined?

- Finding Your County's USDA Loan Limits

- Benefits of USDA Loans

Understanding USDA County Loan Limits

When it comes to purchasing a home, understanding the financial options available to you is crucial. One of the most beneficial programs for eligible homebuyers is the USDA loan, which is designed to promote homeownership in rural areas. However, before you dive into the application process, it’s essential to understand the USDA County Loan Limits that can impact your eligibility and borrowing capacity.

What Are USDA County Loan Limits?

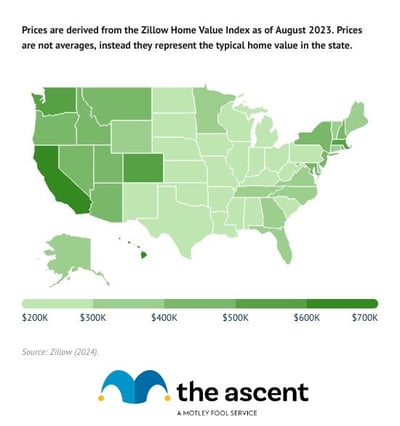

The USDA County Loan Limits refer to the maximum amount of money that a borrower can receive through the USDA Rural Development Guaranteed Housing Loan Program. These limits vary by county and are influenced by the median home prices in those areas. The USDA aims to ensure that low to moderate-income individuals and families have access to affordable housing options, and the county loan limits play a significant role in this initiative.

Why Are USDA County Loan Limits Important?

Understanding the USDA County Loan Limits is essential for several reasons. First, it helps potential homebuyers gauge their purchasing power. Knowing the maximum loan amount can assist you in budgeting for your new home and understanding what kind of properties are within your reach. Additionally, being aware of these limits can prevent disappointment when you find a home you love, only to realize it exceeds the allowable loan amount in your county.

How Are USDA County Loan Limits Determined?

USDA County Loan Limits are determined based on various factors, including the median home prices in each county and the overall economic conditions. The USDA conducts regular assessments to ensure that the limits reflect current market trends and provide adequate support to homebuyers in rural areas. This means that the limits can change annually, so it's essential to stay updated on the latest figures when considering a USDA loan.

Finding Your County's USDA Loan Limits

To find the USDA County Loan Limits for your specific area, you can visit the official USDA website or contact your local USDA Rural Development office. These resources provide detailed information on the limits for each county, enabling you to make informed decisions about your home purchase. Additionally, many real estate websites and mortgage lenders also provide tools to help you determine the limits in your area.

Benefits of USDA Loans

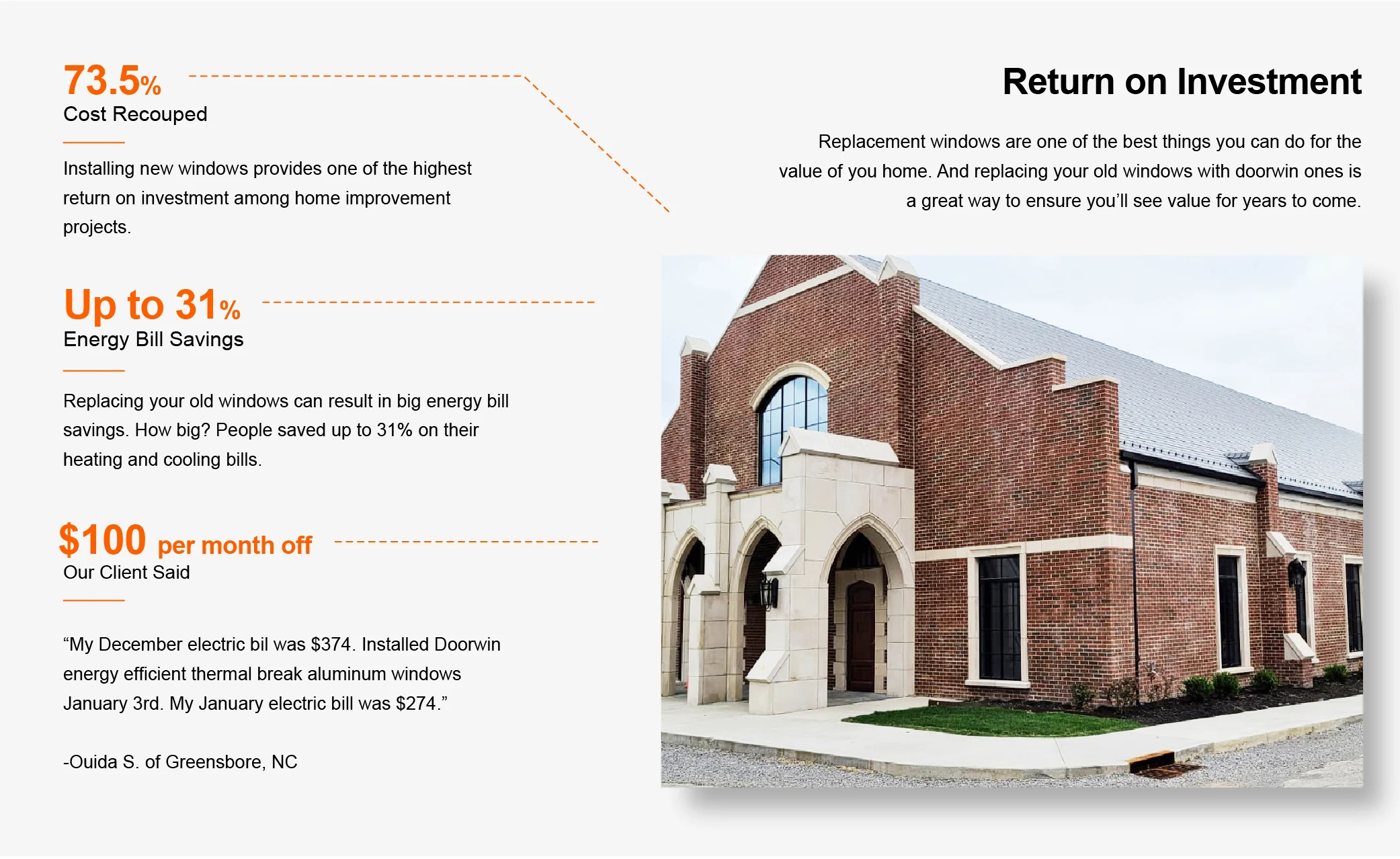

In addition to the USDA County Loan Limits, there are numerous benefits associated with USDA loans. For starters, these loans often come with lower interest rates compared to conventional loans, making them an attractive option for first-time homebuyers. Furthermore, USDA loans require no down payment, which significantly reduces the upfront costs associated with purchasing a home. This feature is particularly beneficial for those who may struggle to save for a traditional down payment.

In summary, understanding the USDA County Loan Limits is a vital step in the home buying process for those looking to purchase property in rural areas. By familiarizing yourself with these limits, you can better navigate your options and make informed decisions that align with your financial goals. With the added benefits of USDA loans, including low interest rates and no down payment requirements, achieving your dream of homeownership may be more attainable than you think. Don’t hesitate to explore your options and take the first step toward securing your new home today!