### Unlock Your Dream Home: The Ultimate Mortgage Home Loan Calculator Guide

Are you dreaming of owning your own home but feeling overwhelmed by the financial aspects? Understanding mortgage loans can be complex, but with the right t……

Are you dreaming of owning your own home but feeling overwhelmed by the financial aspects? Understanding mortgage loans can be complex, but with the right tools, you can navigate this journey with confidence. Enter the **mortgage home loan calculator**—your essential companion in deciphering the costs associated with home buying.

#### What is a Mortgage Home Loan Calculator?

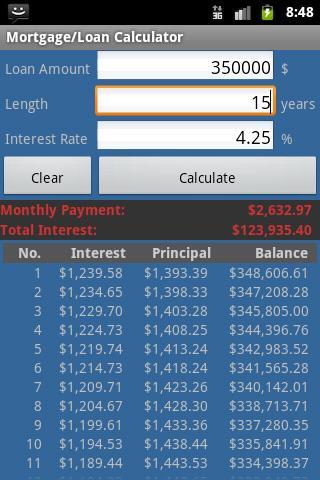

A **mortgage home loan calculator** is an online tool designed to help potential homebuyers estimate their monthly mortgage payments based on various inputs. This calculator considers factors such as the loan amount, interest rate, loan term, and down payment. By providing these details, you can gain insights into your potential financial commitments, making it easier to plan your budget.

#### Why Use a Mortgage Home Loan Calculator?

1. **Clarity on Costs**: One of the primary benefits of using a **mortgage home loan calculator** is the clarity it provides. By inputting your specific financial information, you can see a breakdown of your monthly payments, including principal, interest, taxes, and insurance.

2. **Budget Planning**: Understanding your mortgage payments helps you create a realistic budget. You can assess what you can afford and avoid falling into financial strain after purchasing your home.

3. **Comparing Loan Options**: Different lenders offer various interest rates and terms. Using a **mortgage home loan calculator** allows you to compare different scenarios and find the best option suited to your financial situation.

4. **Interest Rate Impact**: The calculator can show you how changes in interest rates affect your monthly payments. This is crucial for making informed decisions, especially in fluctuating market conditions.

5. **Down Payment Decisions**: The amount you decide to put down as a down payment significantly influences your mortgage. With a calculator, you can experiment with different down payment amounts to see how they impact your overall loan.

#### How to Use a Mortgage Home Loan Calculator

Using a **mortgage home loan calculator** is straightforward. Here’s a step-by-step guide:

1. **Enter the Home Price**: Start by inputting the total price of the home you wish to purchase.

2. **Input the Down Payment**: Specify how much you plan to put down initially. This will help determine your loan amount.

3. **Select the Interest Rate**: Input the current interest rate you expect to receive. You can often find this information through lenders or financial websites.

4. **Choose Your Loan Term**: Most mortgages come in 15 or 30-year terms. Choose the one that best fits your financial goals.

5. **Additional Costs**: Don’t forget to include property taxes, homeowner’s insurance, and any private mortgage insurance (PMI) if applicable.

6. **Calculate**: Click the calculate button to see your estimated monthly payments.

#### Final Thoughts

The journey to homeownership is filled with excitement and challenges. By utilizing a **mortgage home loan calculator**, you equip yourself with the knowledge needed to make informed decisions. This tool not only simplifies the complexities of mortgage calculations but also empowers you to take control of your financial future.

In conclusion, whether you're a first-time homebuyer or looking to refinance, a **mortgage home loan calculator** is an invaluable resource. It helps demystify the mortgage process, allowing you to focus on what truly matters—finding the perfect home for you and your family. Start your journey today and unlock the door to your dream home!