How to Pay Off Equity Loan Faster: Unlocking Financial Freedom

Guide or Summary:Understanding Your Equity Loan Make Extra Payments Refinance Your Loan Create a Budget Use Windfalls Wisely Prioritize Your Debt Set Up Aut……

Guide or Summary:

- Understanding Your Equity Loan

- Make Extra Payments

- Refinance Your Loan

- Create a Budget

- Use Windfalls Wisely

- Prioritize Your Debt

- Set Up Automatic Payments

- Consult a Financial Advisor

Paying off an equity loan can often feel like a daunting task, but with the right strategies, you can expedite the process and achieve financial freedom sooner than you think. In this comprehensive guide, we will explore effective methods and tips on how to pay off equity loan faster, ensuring that you can minimize interest payments and reduce your debt burden.

Understanding Your Equity Loan

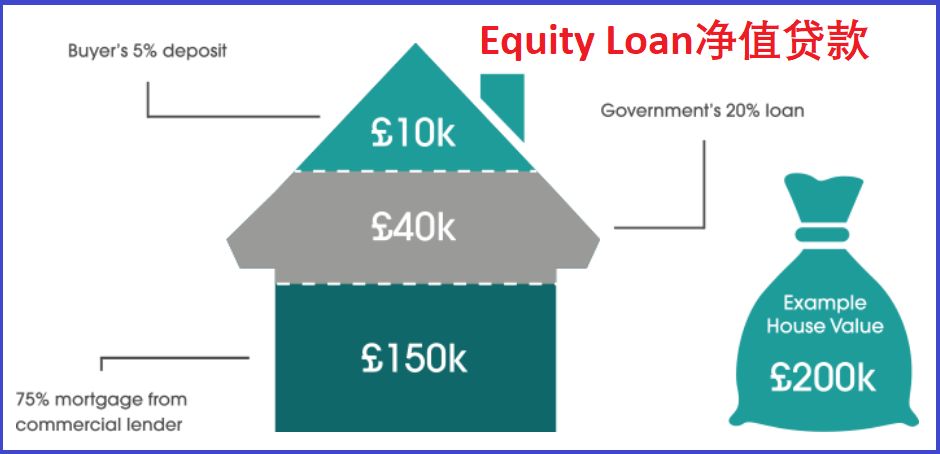

Before diving into the strategies, it’s essential to understand what an equity loan is. An equity loan, also known as a home equity loan, allows homeowners to borrow against the equity they have built in their property. While this can provide you with necessary funds, it also means taking on additional debt. Therefore, learning how to pay off equity loan faster is crucial for financial health.

1. Make Extra Payments

One of the most effective ways to pay off your equity loan faster is by making extra payments. If your loan allows for it, consider making bi-weekly payments instead of monthly ones. This approach can help you pay off your loan quicker and save on interest. Even small additional payments can make a significant difference over time.

2. Refinance Your Loan

Refinancing your equity loan can be a smart move if you can secure a lower interest rate. By reducing your interest rate, you can allocate more of your payments toward the principal balance, leading to faster payoff. Research various lenders and compare their offers to find the best refinancing option that suits your financial situation.

3. Create a Budget

A well-structured budget can help you identify areas where you can cut back on expenses. By reallocating those funds toward your equity loan, you can increase your monthly payment and pay off the loan faster. Track your spending habits and look for opportunities to save, such as dining out less or canceling unused subscriptions.

4. Use Windfalls Wisely

Whenever you receive unexpected funds, such as a tax refund, bonus, or inheritance, consider using a portion of that money to make a lump-sum payment on your equity loan. This strategy can significantly reduce your principal balance and the amount of interest you’ll pay over the life of the loan.

5. Prioritize Your Debt

If you have multiple debts, prioritize paying off high-interest loans first. However, if your equity loan has a lower interest rate, it might be beneficial to focus on it once high-interest debts are cleared. This approach can help you save money in the long run, allowing you to allocate more towards your equity loan.

6. Set Up Automatic Payments

Setting up automatic payments can help ensure that you never miss a payment, which can lead to late fees and additional interest. By automating your payments, you can also consider scheduling extra payments to be made automatically, which can help you stay on track with your goal of paying off the loan faster.

7. Consult a Financial Advisor

If you’re unsure about the best strategy for your financial situation, consulting a financial advisor can provide you with tailored advice. They can help you create a personalized plan for how to pay off equity loan faster based on your income, expenses, and financial goals.

Paying off an equity loan faster is not just about making larger payments; it’s about being strategic with your finances. By understanding your loan, making extra payments, refinancing, budgeting wisely, using windfalls, prioritizing your debts, automating payments, and seeking professional advice, you can take control of your financial future. Start implementing these strategies today and watch your equity loan diminish, leading you to a path of financial freedom.