Discover the Best California Installment Loans Online for Your Financial Needs

Guide or Summary:What Are California Installment Loans Online?Benefits of Choosing California Installment Loans OnlineHow to Apply for California Installmen……

Guide or Summary:

- What Are California Installment Loans Online?

- Benefits of Choosing California Installment Loans Online

- How to Apply for California Installment Loans Online

When it comes to managing finances, finding the right loan can make all the difference. If you're in California and searching for flexible financing options, you might want to explore the world of California installment loans online. These loans offer a convenient way to access funds, whether you need to cover unexpected expenses, consolidate debt, or finance a significant purchase.

What Are California Installment Loans Online?

California installment loans online are a type of personal loan that allows borrowers to receive a lump sum of money, which is then paid back in fixed monthly installments over a predetermined period. This structure makes it easier for borrowers to budget their finances, as they know exactly how much they need to pay each month. Unlike traditional payday loans, which often come with high-interest rates and short repayment terms, installment loans typically offer more manageable terms and lower interest rates.

Benefits of Choosing California Installment Loans Online

1. **Convenience**: One of the primary advantages of opting for California installment loans online is the convenience they provide. You can apply from the comfort of your home, eliminating the need to visit a physical bank or lender. The online application process is usually quick and straightforward, allowing you to receive a decision in a matter of minutes.

2. **Flexible Loan Amounts**: Whether you need a small loan to cover a minor expense or a larger sum for a major purchase, California installment loans online can accommodate various financial needs. Lenders often offer a range of loan amounts, giving you the flexibility to choose the right option for your situation.

3. **Fixed Repayment Terms**: With California installment loans online, you can enjoy the peace of mind that comes with fixed repayment terms. This means you won't have to worry about fluctuating interest rates or variable payment amounts. Instead, you can plan your budget around a consistent monthly payment.

4. **Improved Credit Opportunities**: Taking out an installment loan and making timely payments can positively impact your credit score. This is especially beneficial if you're looking to improve your credit for future financial endeavors, such as buying a home or securing a car loan.

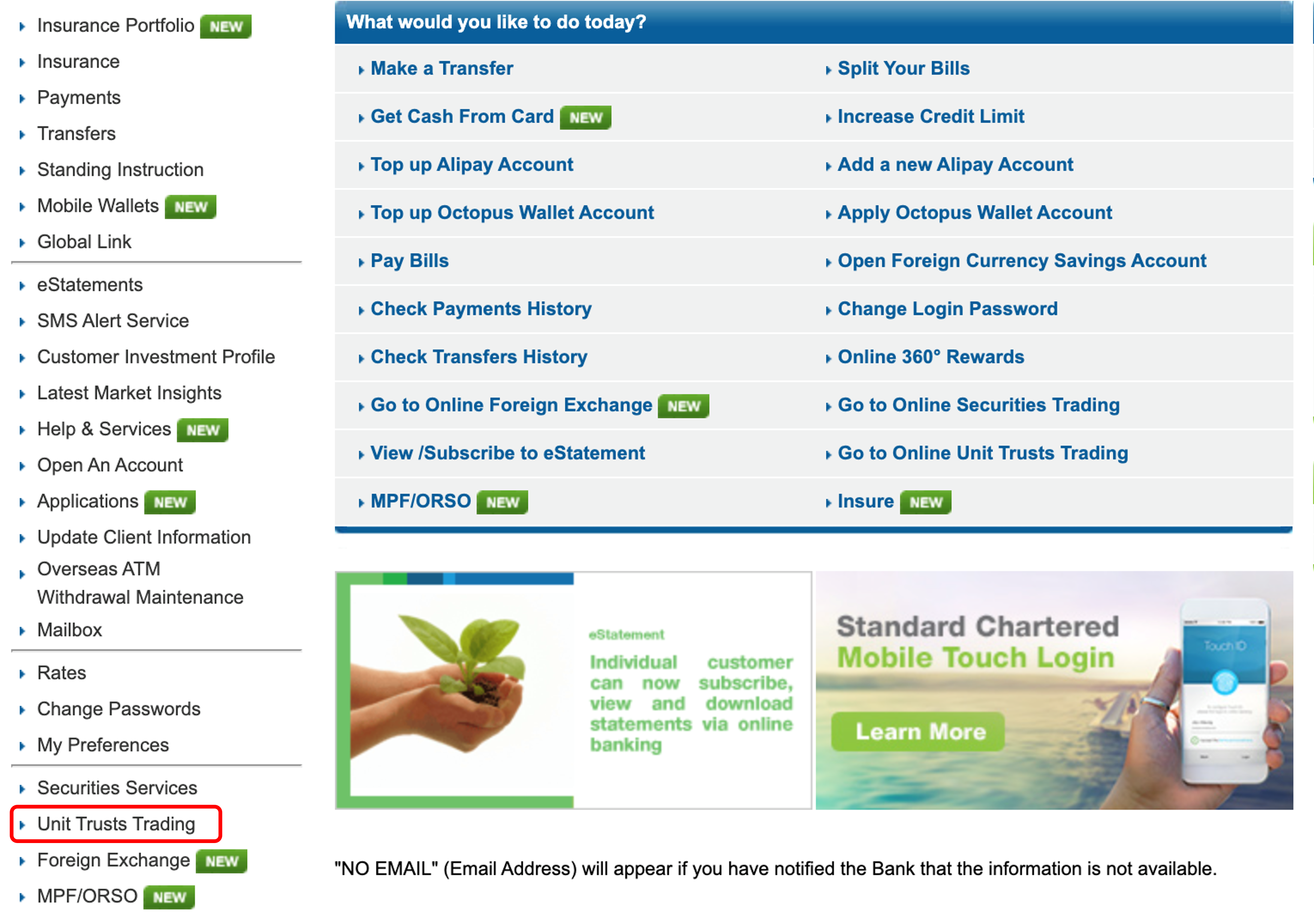

How to Apply for California Installment Loans Online

Applying for California installment loans online is a straightforward process. Here are the steps you typically need to follow:

1. **Research Lenders**: Start by researching reputable online lenders that offer installment loans in California. Look for reviews, interest rates, and terms to find the best fit for your needs.

2. **Complete the Application**: Once you've chosen a lender, fill out their online application form. You'll need to provide personal information, including your income, employment details, and financial history.

3. **Submit Required Documents**: Many lenders will ask for documentation to verify your income and identity. This may include pay stubs, bank statements, and a government-issued ID.

4. **Review Loan Terms**: If approved, you'll receive a loan offer detailing the amount, interest rate, and repayment schedule. Take the time to read through the terms carefully before accepting the loan.

5. **Receive Funds**: After accepting the loan, the funds are typically deposited into your bank account within one to two business days. You can then use the money for your intended purpose.

In summary, California installment loans online present a viable solution for those in need of financial assistance. With their convenience, flexible terms, and potential to improve your credit score, these loans can help you navigate various financial challenges. However, it's essential to borrow responsibly and ensure that you can meet the repayment terms to avoid any negative impact on your financial health. By doing your research and choosing a reputable lender, you can secure the funding you need while maintaining peace of mind.