Unlocking the Potential of Construction Loans in Maryland: A Comprehensive Guide

Guide or Summary:Understanding Construction Loans in MarylandEligibility and Requirements for Construction Loans in MarylandSecuring a Construction Loan in……

Guide or Summary:

- Understanding Construction Loans in Maryland

- Eligibility and Requirements for Construction Loans in Maryland

- Securing a Construction Loan in Maryland

When it comes to embarking on a construction project in the state of Maryland, securing the right financing is crucial. One of the most effective ways to achieve this is through construction loans. These loans are specifically designed to cater to the unique needs of construction projects, offering flexibility, competitive interest rates, and tailored repayment terms that can make the difference between a successful build and a financial strain.

In this comprehensive guide, we delve into the intricacies of construction loans in Maryland, providing insights into how these loans work, the benefits they offer, and the steps you need to take to secure one. Whether you're a seasoned contractor or a novice in the construction industry, understanding the landscape of construction loans in Maryland is essential for navigating the complexities of building projects with confidence.

Understanding Construction Loans in Maryland

Construction loans in Maryland are designed to provide the necessary capital for the construction, renovation, or improvement of a property. These loans are typically short-term, with repayment terms ranging from a few months to several years, depending on the project's timeline and the lender's requirements.

One of the primary advantages of construction loans in Maryland is their flexibility. These loans allow you to draw on the funds as needed, providing the flexibility to allocate resources where they're most critical during the construction phase. This flexibility is particularly beneficial for projects that may experience unforeseen delays or require additional materials or labor.

Another key benefit of construction loans in Maryland is their competitive interest rates. Lenders recognize the unique demands of construction projects and often offer favorable interest rates to attract borrowers. These rates can significantly reduce the overall cost of your project, making it more financially viable.

Eligibility and Requirements for Construction Loans in Maryland

To qualify for a construction loan in Maryland, you'll need to meet certain eligibility criteria and provide detailed documentation. These requirements typically include:

- A solid credit history: Lenders will review your credit score and history to assess your ability to repay the loan.

- A down payment: While not always required, a down payment can demonstrate your commitment to the project and your ability to cover initial costs.

- Detailed project plans: Lenders will want to see comprehensive plans for the construction project, including architectural drawings, cost estimates, and a timeline.

- Proof of insurance: To protect against unforeseen events, lenders will require proof of insurance for the property and any additional structures being built.

Securing a Construction Loan in Maryland

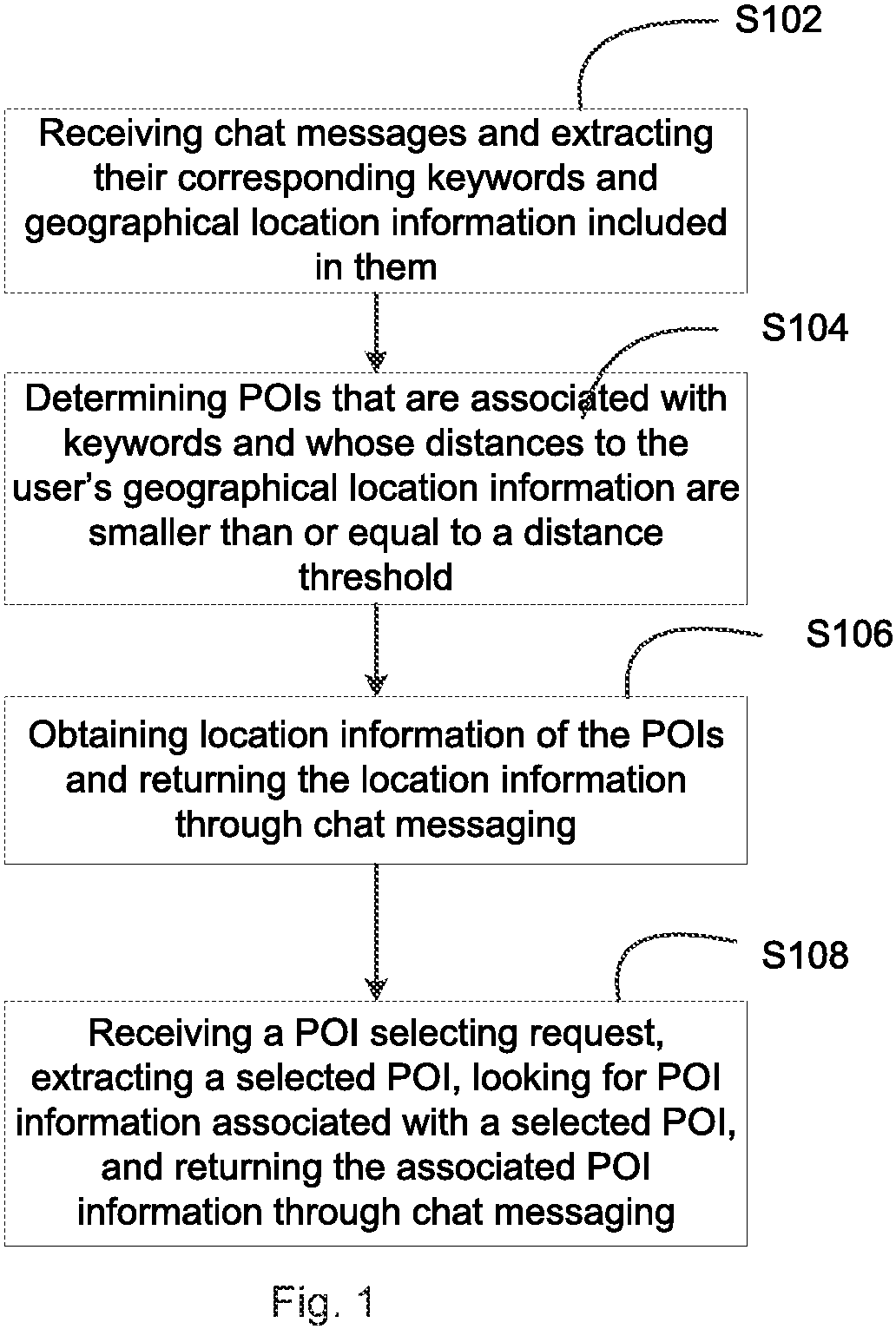

Securing a construction loan in Maryland involves several key steps. Here's a breakdown of the process:

1. **Research and Compare Lenders**: Start by researching different lenders that offer construction loans in Maryland. Look for lenders with a strong reputation, favorable interest rates, and flexible repayment terms.

2. **Prepare Your Application**: Compile all the necessary documentation, including your credit report, financial statements, project plans, and proof of insurance.

3. **Submit Your Application**: Once your application is complete, submit it to the lender of your choice. Be prepared to answer any questions the lender may have and provide additional information if required.

4. **Negotiate Terms**: If your application is approved, you'll need to negotiate the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan.

5. **Draw on Funds**: Once the loan is secured, you can begin drawing on the funds as needed to cover the costs of your construction project.

In conclusion, construction loans in Maryland offer a flexible, competitive financing option for those embarking on construction projects in the state. By understanding the benefits, eligibility criteria, and application process, you can navigate the complexities of securing a construction loan with confidence. Whether you're building a new home, renovating an existing property, or expanding your business, a construction loan in Maryland can provide the financial support you need to bring your vision to life.