Fiona Loan Requirements – A Comprehensive Guide

Guide or Summary:Fiona Fiona is a name that evokes images of grace, beauty, and wisdom. It's a name that has been cherished for centuries, and it's no surpr……

Guide or Summary:

- Fiona Fiona is a name that evokes images of grace, beauty, and wisdom. It's a name that has been cherished for centuries, and it's no surprise that many people are interested in learning more about the loan requirements for those with the name Fiona. In this comprehensive guide, we'll delve into everything you need to know about Fiona loan requirements, including how to apply, what you'll need, and how to increase your chances of approval.

- Loan When it comes to loans, there are many different types to choose from, each with its own set of requirements and benefits. Whether you're looking for a personal loan, a business loan, or a mortgage, understanding the loan requirements is crucial. In this section of our guide, we'll explore the different types of loans available and discuss the specific requirements for each.

- Requirements Loan requirements can vary widely depending on the type of loan you're applying for, as well as your personal financial situation. Generally, lenders will look at your credit score, income, employment history, and debt-to-income ratio when evaluating your loan application. In this section of our guide, we'll discuss the most common loan requirements and provide tips on how to meet them.

- Fiona So, how do the loan requirements for someone named Fiona differ from those for others? While there's no specific "Fiona" requirement that we're aware of, there may be certain biases or preferences that lenders have based on the name. For example, some lenders may be more hesitant to approve loans for applicants with unusual or uncommon names. However, it's important to remember that the most important factor in determining loan approval is your financial situation and ability to repay the loan.

- Loan Requirements Regardless of your name, there are several key factors that lenders will consider when evaluating your loan application. These include:

- How to Apply Once you've reviewed the loan requirements and determined that you meet the criteria, it's time to start the application process. Here are the general steps involved in applying for a loan:

- Increasing Your Chances of Approval While you can't control every aspect of the loan approval process, there are several steps you can take to increase your chances of getting approved for a loan:

Fiona Fiona is a name that evokes images of grace, beauty, and wisdom. It's a name that has been cherished for centuries, and it's no surprise that many people are interested in learning more about the loan requirements for those with the name Fiona. In this comprehensive guide, we'll delve into everything you need to know about Fiona loan requirements, including how to apply, what you'll need, and how to increase your chances of approval.

Loan When it comes to loans, there are many different types to choose from, each with its own set of requirements and benefits. Whether you're looking for a personal loan, a business loan, or a mortgage, understanding the loan requirements is crucial. In this section of our guide, we'll explore the different types of loans available and discuss the specific requirements for each.

Requirements Loan requirements can vary widely depending on the type of loan you're applying for, as well as your personal financial situation. Generally, lenders will look at your credit score, income, employment history, and debt-to-income ratio when evaluating your loan application. In this section of our guide, we'll discuss the most common loan requirements and provide tips on how to meet them.

Fiona So, how do the loan requirements for someone named Fiona differ from those for others? While there's no specific "Fiona" requirement that we're aware of, there may be certain biases or preferences that lenders have based on the name. For example, some lenders may be more hesitant to approve loans for applicants with unusual or uncommon names. However, it's important to remember that the most important factor in determining loan approval is your financial situation and ability to repay the loan.

Loan Requirements Regardless of your name, there are several key factors that lenders will consider when evaluating your loan application. These include:

- Your credit score: A higher credit score typically means lower interest rates and more favorable loan terms.

- Your income: Lenders will want to ensure that you have a stable income that can cover your loan payments.

- Your employment history: A long and steady employment history can help demonstrate your financial stability.

- Your debt-to-income ratio: This ratio compares your monthly debt payments to your monthly income. Lenders prefer to see a lower ratio, as it indicates that you have more disposable income to put towards your loan payments.

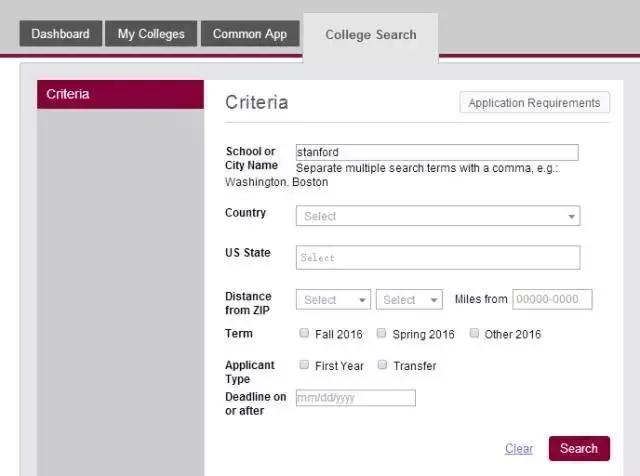

How to Apply Once you've reviewed the loan requirements and determined that you meet the criteria, it's time to start the application process. Here are the general steps involved in applying for a loan:

1. Choose the type of loan that best fits your needs.

2. Research lenders and compare interest rates and terms.

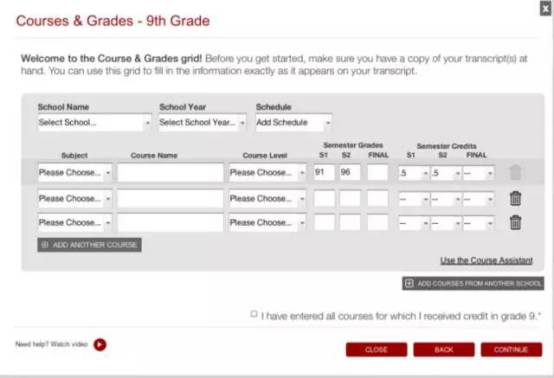

3. Gather all the necessary documents, including proof of income, employment history, and identification.

4. Complete the loan application and submit it to the lender.

5. Wait for the lender to review your application and make a decision.

Increasing Your Chances of Approval While you can't control every aspect of the loan approval process, there are several steps you can take to increase your chances of getting approved for a loan:

- Improve your credit score: Pay your bills on time, keep your credit card balances low, and avoid opening new credit accounts shortly before applying for a loan.

- Save for a down payment: If you're applying for a mortgage or other type of loan that requires a down payment, save as much as you can before applying.

- Provide detailed documentation: Make sure to provide all the documentation requested by the lender, including tax returns, bank statements, and employment records.

- Shop around: Don't be afraid to shop around and compare loan offers from different lenders. You may be able to find a better rate or more favorable terms.

In conclusion, understanding the Fiona loan requirements is an important step in the loan application process. By reviewing the loan requirements and taking steps to improve your financial situation, you can increase your chances of getting approved for a loan. Remember, the most important factor in determining loan approval is your ability to repay the loan, so make sure to carefully consider your financial situation before applying for a loan.