ky loans for bad credit

Guide or Summary:Understanding Ky Loans for Bad CreditWhy Choose Ky Loans for Bad Credit?In a world where financial stability is paramount, securing a loan……

Guide or Summary:

In a world where financial stability is paramount, securing a loan has become an essential part of life for many. However, for those with a less-than-stellar credit history, the process of obtaining financing can be daunting. Enter Ky Loans for Bad Credit – a beacon of hope for individuals seeking a lifeline without being bogged down by stringent credit requirements.

Understanding Ky Loans for Bad Credit

Ky Loans for Bad Credit is a financial institution that specializes in providing loans to individuals with less-than-perfect credit scores. Recognizing the unique challenges faced by borrowers with credit issues, Ky Loans for Bad Credit has developed a streamlined and flexible approach to lending. By offering a range of loan products tailored to the specific needs of its clientele, Ky Loans for Bad Credit aims to make the process of obtaining financing accessible and straightforward.

Why Choose Ky Loans for Bad Credit?

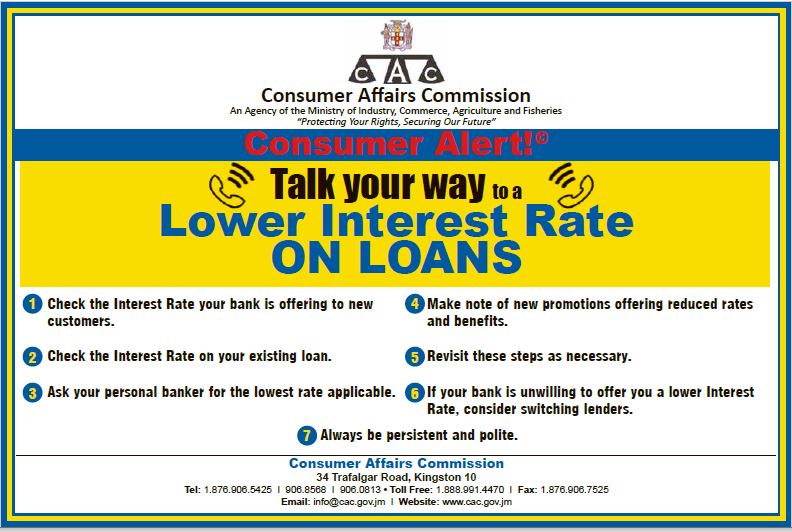

1. **Flexible Credit Requirements**: Ky Loans for Bad Credit understands that a poor credit score does not necessarily reflect an individual's ability to repay a loan. As such, they have relaxed credit criteria to accommodate borrowers with a variety of credit histories. This inclusive approach ensures that more people have access to the financial support they need.

2. **Competitive Interest Rates**: While other lenders may impose high-interest rates on those with bad credit, Ky Loans for Bad Credit prides itself on offering competitive rates. By doing so, they aim to reduce the financial burden on borrowers and make it easier for them to manage their repayments.

3. **Streamlined Application Process**: Ky Loans for Bad Credit recognizes that navigating through traditional loan application processes can be overwhelming, especially for those with poor credit. To address this, they have streamlined their application process to minimize hassle and maximize efficiency. This means that borrowers can secure the funds they need with minimal paperwork and a swift turnaround time.

4. **Transparent Loan Terms**: Transparency is a cornerstone of Ky Loans for Bad Credit's ethos. They believe that borrowers should have all the information they need to make informed decisions about their loans. This includes clear and concise loan terms, including interest rates, repayment schedules, and any associated fees. By providing this level of transparency, Ky Loans for Bad Credit builds trust with its clients and fosters a positive relationship based on mutual respect and understanding.

5. **Ongoing Support**: At Ky Loans for Bad Credit, the journey doesn't end with the approval of a loan. They provide ongoing support to ensure that borrowers are equipped with the tools they need to successfully manage their repayments. This includes financial education resources, personalized advice, and access to customer service for any queries or concerns that may arise.

In a financial landscape that can sometimes feel unforgiving, particularly for those with credit challenges, Ky Loans for Bad Credit stands out as a beacon of hope. By offering flexible credit requirements, competitive interest rates, a streamlined application process, transparent loan terms, and ongoing support, they make the dream of financial stability attainable for a broader audience. Whether you're facing temporary financial difficulties or looking to invest in your future, Ky Loans for Bad Credit is ready to assist you in taking the next step towards a brighter financial horizon. Embrace the opportunity to secure the funds you need with Ky Loans for Bad Credit – your trusted partner in financial empowerment.