Understanding Federal Student Loans FAFSA: Your Comprehensive Guide to Financial Aid

#### What Are Federal Student Loans FAFSA?Federal student loans are loans provided by the government to help students pay for their education. The Free Appl……

#### What Are Federal Student Loans FAFSA?

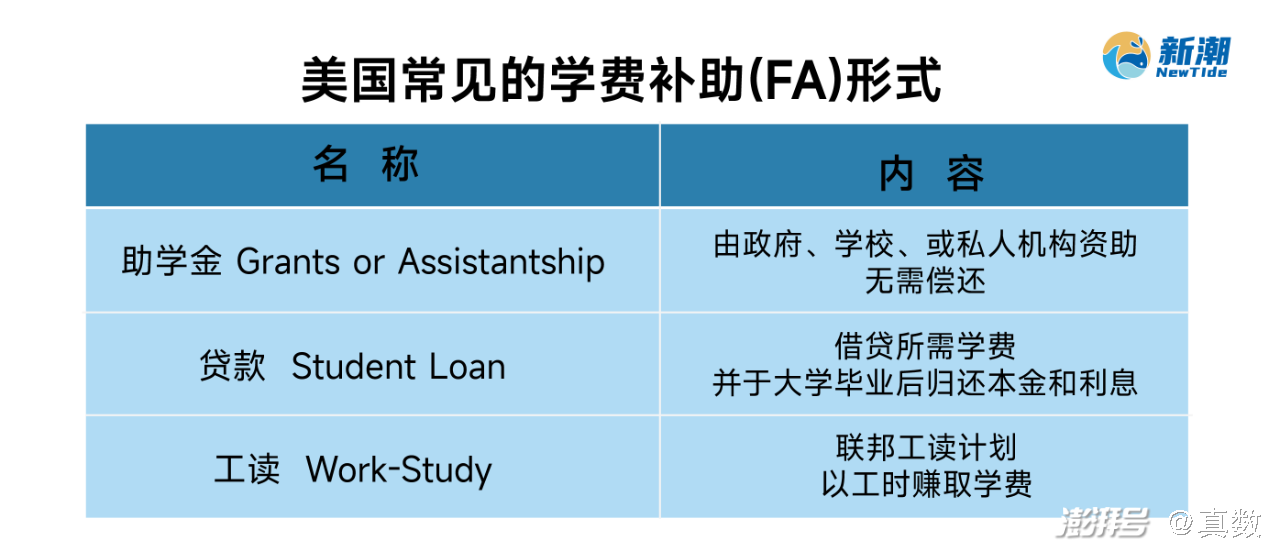

Federal student loans are loans provided by the government to help students pay for their education. The Free Application for Federal Student Aid (FAFSA) is the key to accessing these loans, as it determines your eligibility for federal financial aid, including grants, work-study, and federal student loans.

#### How to Apply for Federal Student Loans FAFSA

To apply for federal student loans, you first need to fill out the FAFSA form. This application collects financial information about you and your family to assess your financial need. The FAFSA must be completed annually, and it is crucial to submit it as early as possible to maximize your chances of receiving aid.

1. **Gather Required Documents:** Before starting the FAFSA, gather your Social Security number, tax returns, bank statements, and other financial documents.

2. **Create an FSA ID:** An FSA ID is a username and password that allows you to access the FAFSA online and sign your application electronically.

3. **Complete the FAFSA:** You can fill out the FAFSA online at the official FAFSA website. The form will ask for your financial information and details about the schools you are interested in.

4. **Submit the FAFSA:** After completing the form, review your information and submit it. You will receive a confirmation once your application is processed.

#### Types of Federal Student Loans

There are several types of federal student loans available, each with its own terms and conditions:

- **Direct Subsidized Loans:** These loans are available to undergraduate students with demonstrated financial need. The government pays the interest while you are in school at least half-time.

- **Direct Unsubsidized Loans:** These loans are available to both undergraduate and graduate students and do not require proof of financial need. Interest accrues while you are in school.

- **Direct PLUS Loans:** These loans are designed for graduate students and parents of dependent undergraduate students. A credit check is required, and the borrower is responsible for all interest.

#### Repaying Federal Student Loans

Repaying federal student loans can be manageable, especially with various repayment plans available. Here are some options:

- **Standard Repayment Plan:** Fixed monthly payments over 10 years.

- **Graduated Repayment Plan:** Payments start lower and increase every two years, also over a 10-year period.

- **Income-Driven Repayment Plans:** These plans adjust your monthly payment based on your income and family size, potentially extending the repayment term.

#### Benefits of Federal Student Loans FAFSA

Federal student loans come with several benefits:

1. **Lower Interest Rates:** Federal loans typically have lower interest rates compared to private loans.

2. **Flexible Repayment Options:** Borrowers can choose from various repayment plans based on their financial situation.

3. **Loan Forgiveness Programs:** Certain federal loans may be eligible for forgiveness after a specific period of qualifying payments.

4. **Deferment and Forbearance:** If you encounter financial hardship, you may be able to temporarily postpone your loan payments.

#### Conclusion

Federal student loans FAFSA play a crucial role in making higher education accessible to millions of students. By understanding the application process, types of loans available, and repayment options, you can make informed decisions about financing your education. Completing the FAFSA is the first step toward securing the financial aid you need to achieve your academic goals. Don’t miss out on the opportunity to invest in your future by applying for federal student loans through FAFSA today!