Loans: Understanding Your Options

If you find yourself struggling with a title loan, you might be considering the option of refinancing or selling your loan to a company that specializes in……

If you find yourself struggling with a title loan, you might be considering the option of refinancing or selling your loan to a company that specializes in this area. In this article, we will explore the concept of **companies that buy out title loans**, how they operate, and what you need to know to make an informed decision.

#### What Are Title Loans?

Title loans are short-term loans where the borrower uses their vehicle title as collateral. These loans typically come with high-interest rates and can lead to a cycle of debt if not managed properly. If you're facing financial difficulties, you may be looking for ways to alleviate the burden of these loans.

#### How Do Companies That Buy Out Title Loans Work?

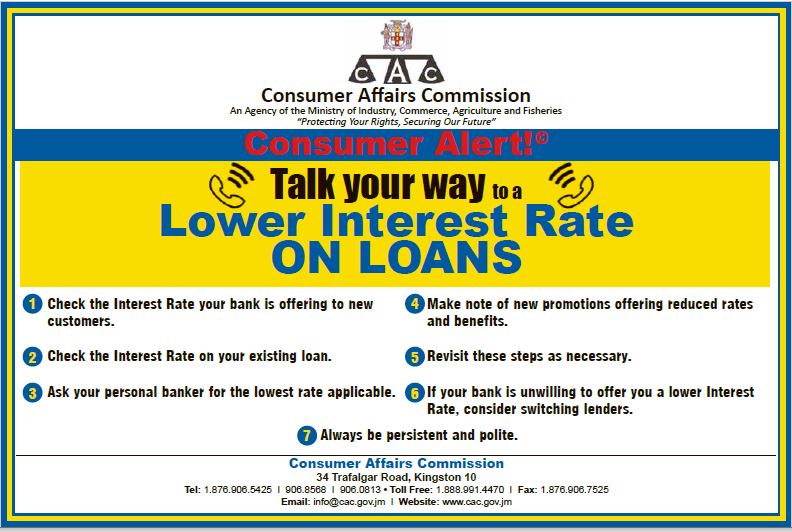

**Companies that buy out title loans** offer a solution to borrowers who want to escape the high-interest rates associated with their existing loans. When you approach these companies, they may offer to pay off your current title loan in exchange for a new loan with potentially better terms. The process usually involves the following steps:

1. **Assessment**: The company will assess your current title loan, including the amount owed and the terms of the loan.

2. **Offer**: After evaluation, they will present you with an offer to buy out your existing loan. This offer may include lower interest rates or extended repayment terms.

3. **Paperwork**: If you accept the offer, you'll go through a paperwork process where the new company pays off your existing loan, and you sign over the title to them.

4. **New Loan Agreement**: You will then enter into a new loan agreement with the buying company, which will outline the new terms.

#### Benefits of Using Companies That Buy Out Title Loans

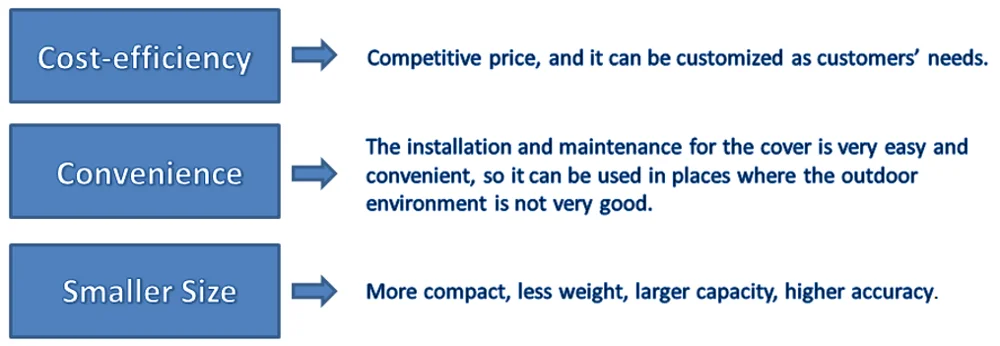

- **Lower Interest Rates**: Many borrowers find that they can secure a lower interest rate by working with companies that buy out title loans, making repayments more manageable.

- **Improved Terms**: These companies often provide more flexible repayment terms, which can help you avoid defaulting on your loan.

- **Debt Relief**: By refinancing your title loan, you can alleviate some financial pressure and reduce the risk of losing your vehicle.

#### Things to Consider

Before deciding to work with a company that buys out title loans, there are several factors to consider:

- **Reputation**: Research the company’s reputation. Look for reviews and testimonials from past clients to ensure they are trustworthy.

- **Fees**: Be aware of any fees associated with the buyout process. Some companies may charge origination fees or other costs that could negate the benefits of refinancing.

- **Loan Terms**: Carefully review the terms of the new loan. Make sure you understand the interest rates, repayment schedule, and any penalties for late payments.

#### Conclusion

For those struggling with title loans, **companies that buy out title loans** can offer a viable solution to regain control over their financial situation. By understanding the process, benefits, and potential pitfalls, you can make an informed decision that best suits your needs. Always do your due diligence and consult with financial advisors if necessary to ensure that you are making the right choice for your financial future.