Unlock Quick Cash with Old Car Title Loans: Your Guide to Fast Financing Solutions

Guide or Summary:What are Old Car Title Loans?How Do Old Car Title Loans Work?Benefits of Old Car Title LoansConsiderations Before Applying#### Introduction……

Guide or Summary:

- What are Old Car Title Loans?

- How Do Old Car Title Loans Work?

- Benefits of Old Car Title Loans

- Considerations Before Applying

#### Introduction to Old Car Title Loans

What are Old Car Title Loans?

Old car title loans are a type of secured loan where borrowers can use their vehicle's title as collateral to obtain quick cash. These loans are particularly appealing to individuals who may not have access to traditional financing methods due to poor credit history or urgent financial needs. By using the title of an older vehicle, borrowers can secure funds quickly while still retaining the use of their car.

How Do Old Car Title Loans Work?

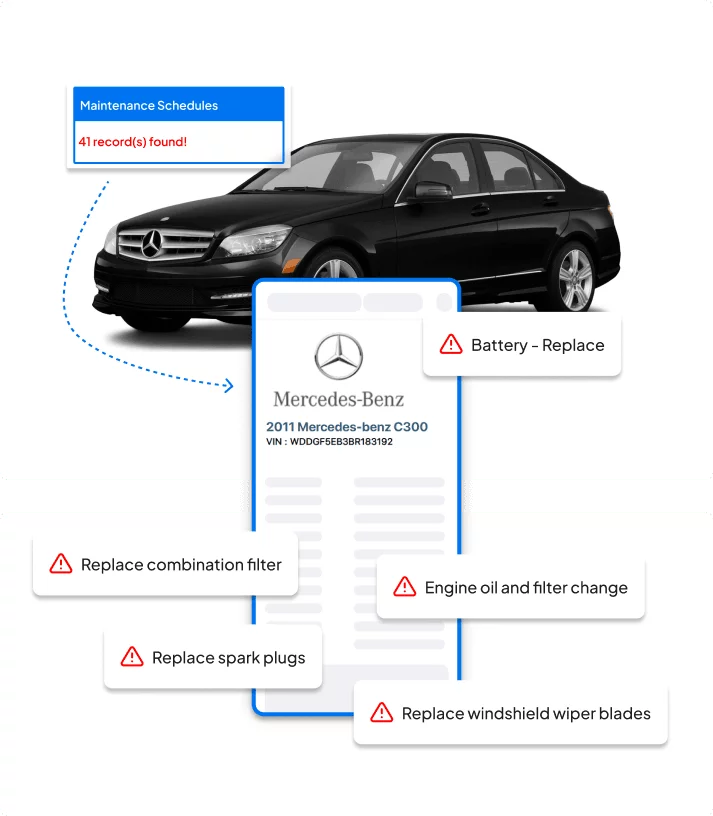

The process of obtaining an old car title loan is relatively straightforward. First, the borrower must own a car outright, meaning there are no existing liens on the vehicle. The lender will assess the car's value, which is typically determined based on its make, model, year, and overall condition. Once the value is established, the lender will offer a loan amount, often ranging from a few hundred to several thousand dollars, depending on the vehicle’s worth.

After agreeing to the loan terms, the borrower must sign over the title to the lender temporarily. This means that while the borrower can continue to use the vehicle, the lender holds the title until the loan is repaid. Repayment terms can vary, but they usually include high-interest rates and short repayment periods, which borrowers should be aware of before committing.

Benefits of Old Car Title Loans

One of the primary advantages of old car title loans is the speed at which funds can be accessed. Many lenders offer same-day approval, allowing borrowers to receive cash within hours of applying. This can be especially beneficial in emergencies, such as unexpected medical expenses or urgent home repairs.

Additionally, old car title loans are accessible to individuals with less-than-perfect credit. Since the loan is secured by the vehicle’s title, lenders are more willing to provide financing even if the borrower has a poor credit score. This opens up opportunities for many who might otherwise be turned away by traditional lenders.

Considerations Before Applying

While old car title loans can provide quick cash, there are several important factors to consider. First, the interest rates on these loans can be significantly higher than traditional loans, which can lead to financial strain if the borrower is unable to repay the loan on time. It’s crucial to read the fine print and understand the total cost of the loan, including any fees associated with late payments or defaults.

Moreover, borrowers should be cautious about the risk of losing their vehicle. If the loan is not repaid as agreed, the lender has the right to repossess the car. This potential loss can have a significant impact on the borrower’s daily life, so it’s essential to ensure that repayment is feasible before taking out a loan.

Old car title loans can be a viable option for those in need of fast cash, especially for individuals with limited access to traditional credit. However, it is vital to approach these loans with caution, understanding the risks and responsibilities involved. By thoroughly researching lenders, comparing terms, and ensuring that repayment is manageable, borrowers can make informed decisions that will help them navigate their financial challenges effectively. If you find yourself in a tight spot, old car title loans may just be the solution you need to unlock quick cash and get back on track.