Understanding the Max DTI for Car Loan: What You Need to Know

Guide or Summary:Debt-to-Income RatioWhy Max DTI MattersFactors Affecting Your DTICalculating Your Debt-to-Income RatioManaging Your Debt-to-Income RatioFin……

Guide or Summary:

- Debt-to-Income Ratio

- Why Max DTI Matters

- Factors Affecting Your DTI

- Calculating Your Debt-to-Income Ratio

- Managing Your Debt-to-Income Ratio

- Final Thoughts on Max DTI for Car Loan

#### Introduction to Max DTI for Car Loan

The term "max DTI for car loan" refers to the maximum debt-to-income ratio that lenders consider acceptable when approving an auto loan. This ratio is a crucial factor in determining your eligibility for financing and the amount you can borrow. Understanding the implications of your DTI can significantly impact your car-buying experience.

#### What is DTI?

Debt-to-Income Ratio

Debt-to-Income Ratio (DTI) is a financial measure that compares your total monthly debt payments to your gross monthly income. It is expressed as a percentage and is used by lenders to assess your ability to manage monthly payments and repay debts. A lower DTI indicates a healthier financial situation, making you a more attractive candidate for loans.

#### Importance of Max DTI for Car Loan

Why Max DTI Matters

Lenders use the max DTI for car loans as a guideline to evaluate risk. A high DTI may suggest that you are over-leveraged, which could lead to difficulties in making payments. Most lenders prefer a DTI below 36%, but some may allow up to 40% or higher, depending on various factors such as credit score and loan type.

#### Factors Influencing Max DTI for Car Loan

Factors Affecting Your DTI

Several factors can influence your DTI, including:

1. **Monthly Income**: The higher your income, the more debt you can typically handle. Lenders will look at your gross income before taxes.

2. **Existing Debt**: This includes all monthly obligations, such as credit card payments, student loans, and mortgages. The more debt you have, the higher your DTI will be.

3. **Credit Score**: A higher credit score can sometimes allow for a higher DTI, as it indicates a lower risk to lenders.

4. **Loan Amount**: The size of the car loan you are seeking will also impact your DTI. A larger loan increases your monthly payments, potentially raising your DTI.

#### How to Calculate Your DTI

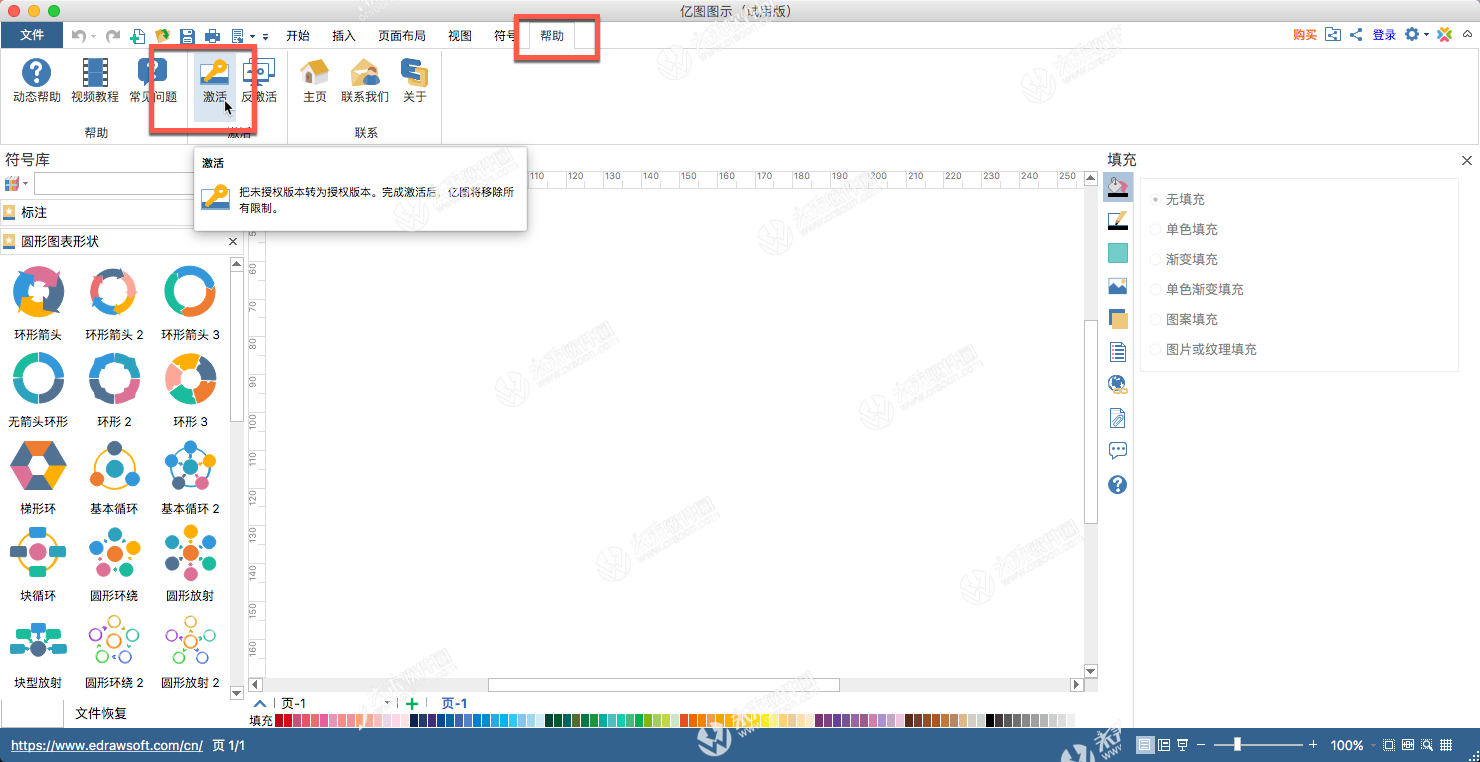

Calculating Your Debt-to-Income Ratio

To calculate your DTI, follow these steps:

1. **Add Up Your Monthly Debt Payments**: Include all recurring debts such as mortgage or rent, car payments, credit card minimum payments, student loans, and any other loans.

2. **Determine Your Gross Monthly Income**: This is your total income before taxes and other deductions.

3. **Divide Your Total Monthly Debt by Your Gross Monthly Income**: Multiply the result by 100 to get a percentage.

For example, if your monthly debt payments total $1,500 and your gross monthly income is $5,000, your DTI would be (1,500 / 5,000) * 100 = 30%.

#### Tips for Managing Your DTI

Managing Your Debt-to-Income Ratio

To improve your chances of securing a car loan, consider the following tips:

1. **Pay Down Existing Debt**: Focus on reducing high-interest debts, which can lower your DTI.

2. **Increase Your Income**: Look for opportunities to boost your income through side jobs or promotions.

3. **Avoid New Debt**: Try not to take on additional debt before applying for a car loan.

4. **Choose an Affordable Loan**: Opt for a car that fits within your budget to keep your DTI manageable.

#### Conclusion

Final Thoughts on Max DTI for Car Loan

Understanding the max DTI for car loans is essential for anyone looking to finance a vehicle. By keeping your DTI within acceptable limits, you can improve your chances of loan approval and secure more favorable terms. Always assess your financial situation and plan accordingly to ensure a smooth car-buying experience.