A Comprehensive Guide on How to Apply for a Construction Loan: Steps, Tips, and Requirements

Guide or Summary:How to apply for a construction loanUnderstanding Construction LoansSteps to Apply for a Construction LoanTips for a Successful Application……

Guide or Summary:

- How to apply for a construction loan

- Understanding Construction Loans

- Steps to Apply for a Construction Loan

- Tips for a Successful Application

How to apply for a construction loan

Applying for a construction loan can be a daunting process, especially for first-time builders. Understanding the necessary steps, requirements, and tips can make the journey smoother and more manageable. This guide will provide you with a comprehensive overview of how to apply for a construction loan, ensuring that you are well-prepared to secure the financing you need for your dream project.

Understanding Construction Loans

Before diving into the application process, it’s essential to understand what a construction loan is. A construction loan is a short-term loan specifically designed to finance the building of a home or other real estate projects. Unlike traditional mortgages, which provide long-term financing, construction loans typically cover only the duration of the building process, usually ranging from six months to a year. Once the construction is complete, the borrower often refinances into a permanent mortgage.

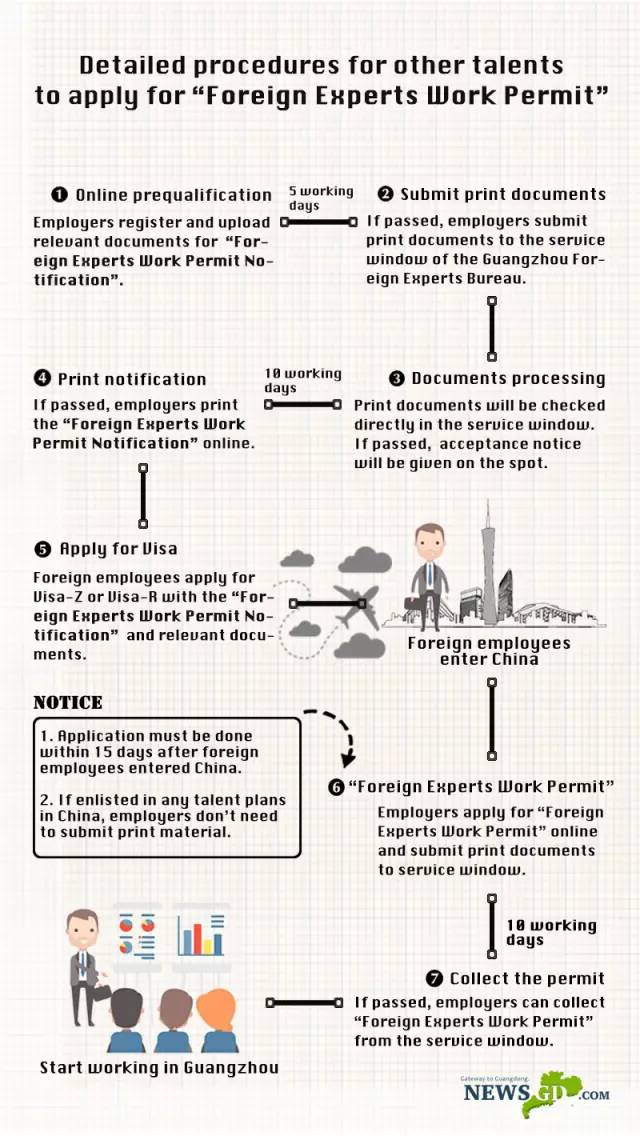

Steps to Apply for a Construction Loan

1. **Assess Your Financial Situation**: Before applying for any loan, it’s crucial to evaluate your financial health. Check your credit score, determine your budget, and consider how much you can afford to borrow. Lenders will look at your credit history, income, and debt-to-income ratio when assessing your application.

2. **Research Lenders**: Not all lenders offer construction loans, so it’s important to shop around. Look for banks, credit unions, and specialized lenders that provide construction financing. Compare interest rates, terms, and fees to find the best option for your needs.

3. **Gather Necessary Documentation**: When applying for a construction loan, you will need to provide various documents, including:

- Proof of income (pay stubs, tax returns)

.jpg)

- Credit history

- A detailed construction plan and timeline

- A budget outlining estimated costs

- Information about the contractor or builder you plan to work with

4. **Submit Your Application**: Once you have all the necessary documents, you can submit your application. Be prepared to answer questions about your project, financial situation, and timeline. Lenders will review your application and may request additional information.

5. **Get Approved**: If your application is approved, the lender will provide you with a loan estimate outlining the terms and costs associated with the loan. Review this carefully and make sure you understand all the details before moving forward.

6. **Draw Schedule**: Construction loans are typically disbursed in stages, known as draws. You will need to work with your lender to create a draw schedule that outlines when funds will be released based on project milestones.

7. **Start Construction**: Once everything is in place, you can begin construction on your new home. Keep in close communication with your lender throughout the process to ensure that everything stays on track and that funds are released as needed.

Tips for a Successful Application

- **Work with a Reputable Builder**: Having a reliable and experienced builder can significantly impact your loan application. Lenders are more likely to approve loans for projects managed by reputable contractors.

- **Be Detailed in Your Plans**: The more detailed your construction plans and budget are, the better. Lenders want to see that you have a clear understanding of the project and its costs.

- **Prepare for Inspections**: Lenders may require inspections at various stages of construction to ensure that the work is progressing as planned. Be prepared for these inspections and ensure that your contractor is aware of them.

- **Consider a Contingency Fund**: Construction projects often encounter unexpected costs. Having a contingency fund can help you cover these expenses without jeopardizing your loan.

In conclusion, understanding how to apply for a construction loan is essential for anyone looking to build a new home or undertake a significant renovation. By following these steps and tips, you can navigate the application process more effectively and increase your chances of securing the financing you need.