Understanding Second Mortgage Loans: A Comprehensive Guide to Financing Your Home

Guide or Summary:What Are Second Mortgage Loans?Types of Second Mortgage LoansBenefits of Second Mortgage LoansConsiderations Before Taking a Second Mortgag……

Guide or Summary:

- What Are Second Mortgage Loans?

- Types of Second Mortgage Loans

- Benefits of Second Mortgage Loans

- Considerations Before Taking a Second Mortgage Loan

- How to Qualify for a Second Mortgage Loan

What Are Second Mortgage Loans?

Second mortgage loans are financial products that allow homeowners to borrow against the equity in their home, in addition to their primary mortgage. These loans can be used for various purposes, such as home improvements, debt consolidation, or funding major expenses. A second mortgage is secured by the property, meaning that if the borrower defaults, the lender has the right to foreclose on the home after the primary mortgage lender has been paid off.

Types of Second Mortgage Loans

There are two main types of second mortgage loans: home equity loans and home equity lines of credit (HELOCs).

1. **Home Equity Loans**: This type of loan provides a lump sum of money that the borrower repays over a fixed term with a fixed interest rate. It is ideal for homeowners who need a specific amount of money for a one-time expense.

2. **Home Equity Lines of Credit (HELOCs)**: A HELOC functions more like a credit card, allowing homeowners to borrow up to a certain limit and pay interest only on the amount drawn. This flexibility makes HELOCs suitable for ongoing expenses or projects.

Benefits of Second Mortgage Loans

Second mortgage loans offer several advantages for homeowners:

- **Access to Cash**: Homeowners can tap into their home equity to access significant amounts of cash for various needs.

- **Lower Interest Rates**: Compared to unsecured loans or credit cards, second mortgage loans typically have lower interest rates since they are secured by the property.

- **Tax Deductibility**: In some cases, the interest paid on second mortgage loans may be tax-deductible, providing additional financial benefits.

Considerations Before Taking a Second Mortgage Loan

While second mortgage loans can be beneficial, there are important factors to consider:

- **Risk of Foreclosure**: Since a second mortgage is secured by the home, failing to repay the loan could result in foreclosure.

- **Higher Monthly Payments**: Borrowers must be prepared for the additional monthly payment on top of their primary mortgage.

- **Closing Costs**: Just like a first mortgage, second mortgages may come with closing costs, which can add to the overall expense.

How to Qualify for a Second Mortgage Loan

Qualifying for a second mortgage loan typically involves several steps:

- **Credit Score**: Lenders will evaluate the borrower’s credit score to determine eligibility and interest rates.

- **Income Verification**: Borrowers must provide proof of income to ensure they can handle the additional debt.

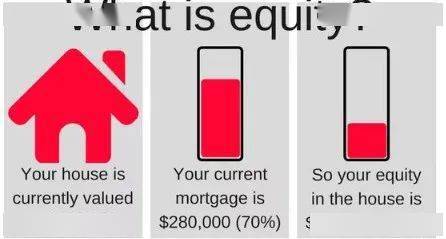

- **Home Equity**: Lenders will assess the amount of equity in the home, which is calculated as the current market value minus the outstanding mortgage balance.

Second mortgage loans can be a powerful financial tool for homeowners looking to leverage their home equity. Whether for home renovations, debt consolidation, or other significant expenses, understanding the ins and outs of second mortgages is crucial. By considering the benefits and risks, as well as evaluating personal financial situations, homeowners can make informed decisions about whether a second mortgage loan is the right choice for them. Always consult with a financial advisor or mortgage specialist to explore the best options available.