"Unlocking Success in the Car Loans Business: Strategies for Growth and Profitability"

Guide or Summary:Introduction to the Car Loans BusinessMarket Trends in the Car Loans BusinessChallenges Faced by the Car Loans BusinessStrategies for Succe……

Guide or Summary:

- Introduction to the Car Loans Business

- Market Trends in the Car Loans Business

- Challenges Faced by the Car Loans Business

- Strategies for Success in the Car Loans Business

- The Future of the Car Loans Business

**Translation of "car loans business":** Car Loans Business

Introduction to the Car Loans Business

The car loans business is a vital segment of the automotive finance industry, providing customers with the necessary funding to purchase vehicles. As the demand for personal and commercial vehicles continues to rise, the car loans business presents lucrative opportunities for lenders, dealerships, and financial institutions. Understanding the dynamics of this market is essential for anyone looking to succeed in this field.

Market Trends in the Car Loans Business

In recent years, the car loans business has experienced significant transformations. With the advent of technology, online lending platforms have emerged, allowing consumers to apply for loans from the comfort of their homes. Additionally, the rise of electric and hybrid vehicles has created new financing options, catering to environmentally conscious consumers. Staying updated on these trends is crucial for businesses aiming to thrive in this competitive landscape.

Challenges Faced by the Car Loans Business

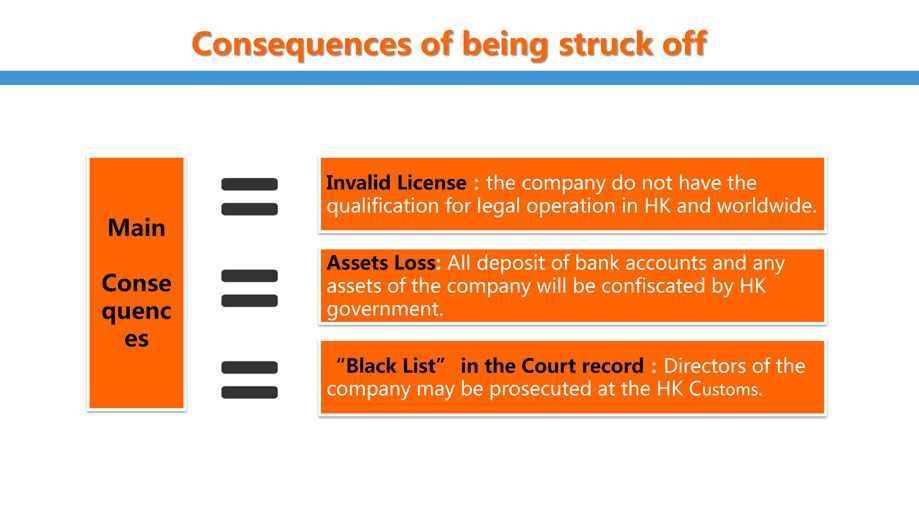

Despite its growth potential, the car loans business is not without challenges. Economic fluctuations, changes in consumer credit behavior, and regulatory requirements can impact loan approval rates and profitability. Moreover, the increasing prevalence of subprime lending poses risks for lenders, necessitating robust risk assessment and management strategies.

Strategies for Success in the Car Loans Business

To excel in the car loans business, companies must adopt effective strategies that enhance customer experience and streamline operations. Here are some key approaches:

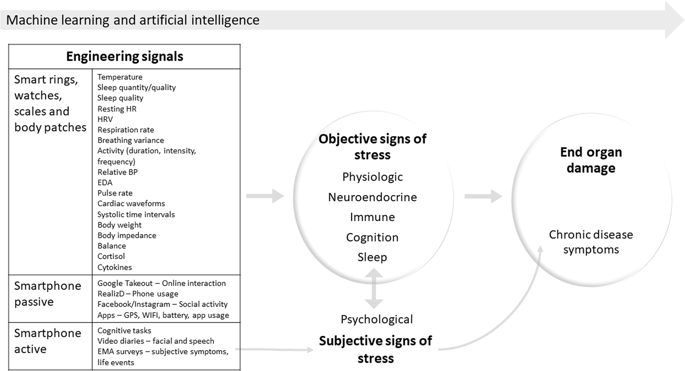

1. **Leverage Technology**: Implementing advanced data analytics and artificial intelligence can help lenders assess creditworthiness more accurately and expedite the loan approval process.

2. **Customer Education**: Providing resources and tools that educate consumers about their financing options can build trust and foster long-term relationships.

3. **Diversify Offerings**: Expanding product offerings to include various loan types, such as leasing options or loans for electric vehicles, can attract a broader customer base.

4. **Strong Partnerships**: Collaborating with car dealerships and manufacturers can create referral networks, driving more business to lenders.

5. **Focus on Customer Service**: Exceptional customer service can differentiate a company in a crowded market. Ensuring that customers have access to support throughout the loan process can enhance satisfaction and loyalty.

The Future of the Car Loans Business

Looking ahead, the car loans business is poised for further evolution. As consumer preferences shift towards sustainability, lenders will need to adapt their offerings to meet the growing demand for green financing. Moreover, the integration of digital wallets and cryptocurrency in car financing could revolutionize payment methods, making transactions more convenient for consumers.

In summary, the car loans business is a dynamic and promising sector within the financial industry. By understanding market trends, addressing challenges, and implementing effective strategies, businesses can unlock significant growth and profitability. As the automotive landscape continues to evolve, staying ahead of the curve will be essential for success in the car loans business.